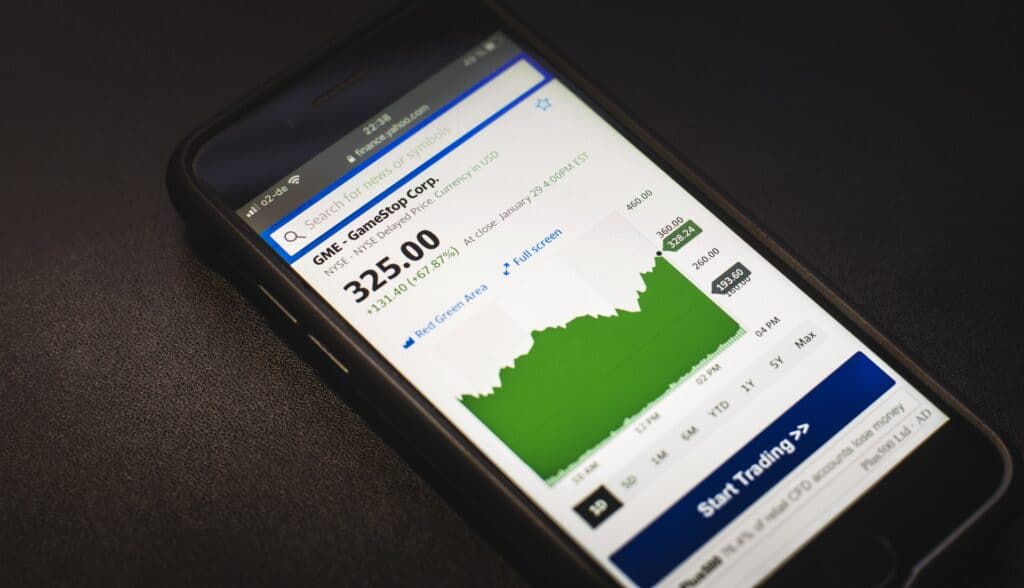

In the last couple of weeks, the GameStop stock seems to have caused a collective obsession, as we’ve watched events unfold with rapt attention. It’s easy to see why the saga has caused such a stir, but what is the truth behind it all?

The GameStop saga explained (simply)…

Basically, the tale goes like this: a well-known but struggling company had short-sellers bet big against them in the equity market. Investors then borrowed and sold shares, in the hopes of repurchasing the shares at a lower price. But – plot twist – the price of the shares didn’t drop, due to a lot of very enthusiastic small traders who are quite comfortable with high risks piling into the stock.

The story goes that the r/WallStreetBets community on Reddit banded together to roughly coordinate their efforts, empowered by the prospect of a low-cost way to make lots of money easily. Some of these industrious Redditors added call options, in the hopes the people who sold them the shares would buy the underlying stock, hedging and driving up the price.

As shorts sank underwater, they were forced to offload GameStop stock which, of course, created a bit of a quandary: in order to get out, they had to buy shares.

Shorts purchased shares so they could close their trades. Meanwhile, the Reddit-fueled frenzy continued to prompt more people to pile in on the action. All of this resulted in parabolic price action or a ‘short squeeze’.

GameStop ended up with a 1744% year-to-date gain, while investors suffered huge losses.

For Citadel, one of the large funds investing in the effort, losses were especially large, forcing them to sell a portion of the business off to private investors to help avoid insolvency. Point72 – Steve Cohen, owner of the Mets’ hedge fund – also suffered huge losses.

The flaw in the logic

While the story has gained an awful lot of momentum and attention in the last week, there are a few flaws in the logic behind the hype. Firstly, the entire affair didn’t start because of a single Redditor who “noticed” that the GameStop stocks were being shorted. The short positions are public knowledge, and companies are shorted all the time. In this sense, there’s absolutely nothing remarkable about the situation.

While hedge funds do manage a lot of other people’s money, and there is a perception that all of those people are rich, the reality is that a lot of the money in hedge funds are the pension funds of regular people. So, while there is a certain romanticism to the notion that the little guy on Reddit brought down a multi-billion dollar corporation and the only people who were hurt were the rich, it’s sadly mistaken.

Ordinary people have been hurt by this.

Secondly, Redditors were not the ones who ‘figured out’ pumping stock as a means of making money. It’s a well-known way of manipulating the financial market. The issue with the misinformation floating around at the moment is that it gives a skewed view of the reality of trading. The impression that’s being made is that this kind of behaviour is acceptable for big companies to do, but nobody wants the ‘little guy’ getting in on the action.

Reddit launching a revolution that gave individuals access to such tactics sounds impressive, but here’s the thing: it’s NOT okay for big companies to do this. It’s an illegal manipulation of the market, and while hedge funds and other big firms use this tactic, they are hit with massive fines when they do.

Closing the ability to trade on a particular stock is NOT censoring, nor is it an attempt to limit crowdfunded investment. It is the usual – and correct! – market response to manipulation and criminal activity and a-priori known market fluctuations.

This is not a new thing. Reddit didn’t invent stock shorting, and it’s certainly not the first time it’s happened.

Moreover, everyone seems to be forgetting that hedge fund managers earn a lot of money – the manager of Melvin Capital made £300m last year.

He hasn’t lost that.

He and his senior staff will have new jobs by next Friday.

Should Melvin Capital face insolvency the people who will wake up with no jobs and no easy recourse for finding new positions are the support staff, the HR department, IT services, and other perfectly ordinary people. These are individuals paid regular salaries who have nothing to do with trading, they just happen to work for a hedge fund.

Getting rich from the GameStop revolution

But here’s the real kicker. Someone – and we’re betting it was the Redditor who started the whole thing – will have got extremely rich from this. The most likely motivation behind all the disinformation floating around about this is a (successful) attempt to convince a lot of people to pump stock which that particular Redditor had an investment in so they could sell it for a massive profit.

Sure some ordinary folk would have made some money if they managed to sell it time but many of those who were involved in the squeeze could have lost money themselves as the GameStop stock price came crashing back down again unless they were lucky enough to get in whilst the price was as low as $4.

What better way to get rich than by empowering the masses into thinking they’re being vigilantes and rule breakers, and will soon be rich themselves?

Do you have an insolvency, technology or corporate matter that you’d like to discuss with the team? Alston Asquith have offices in London and Hertfordshire and can arrange a call to provide some initial advice.

We pride ourselves on our relationship with our clients as well as the service we provide. View some of our feedback on Trustpilot.

Visit our contact page to find out how we can help.